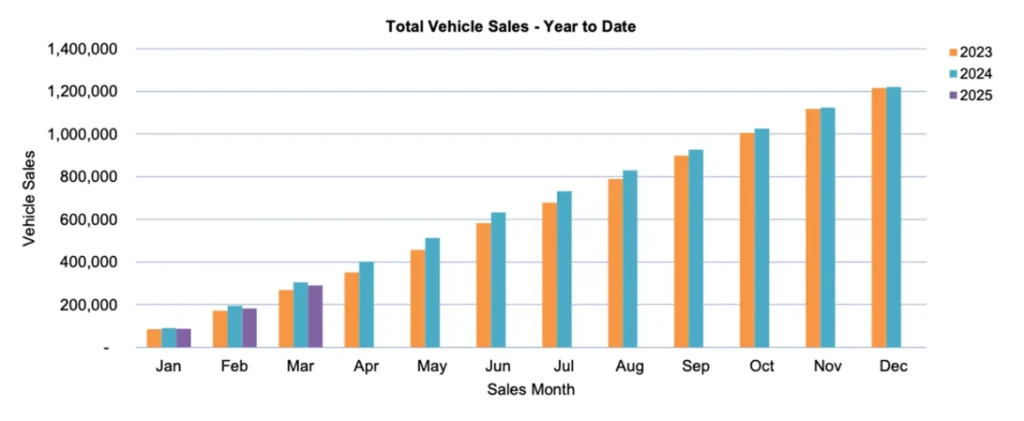

The Australian new car market showed signs of recovery in March 2025, with the Ford Ranger claiming top sales honours for the month—the first time since June 2024. According to data released by the Federal Chamber of Automotive Industries (FCAI), 108,606 vehicles were delivered, rising to 111,617 when including data from the Electric Vehicle Council (EVC), which covers Tesla and Polestar. This marks a 1.2 per cent increase compared to March 2024, reversing a year-on-year downturn experienced earlier in the year.

Get a Roadworthy Certificate fast and conveniently with CARS24, book an appointment for the inspection; the rest is simple.

Top 10 Best-selling Models

| Model | March 2025 | March 2024 | Difference (%) |

| Ford Ranger | 4932 | 5661 | up 8.3 % |

| Toyota RAV4 | 4,321 | 5070 | down 6.2 % |

| Toyota Hilux | 4081 | 3995 | down 3 % |

| Mitsubishi Outlander | 3005 | 2764 | up 3.4 % |

| Toyota LandCruiser Prado | 2871 | 446 | down 7.6 % |

| BYD Shark 6 | 2810 | 0 | up 13.8 % |

| Ford Everest | 2100 | 2264 | up 196.6 % |

| Isuzu D-Max | 2088 | 2465 | up 13.5 % |

| MG ZS | 2020 | 2046 | down 18 % |

| Hyundai Kona | 2011 | 1607 | down 0.6 % |

Read More: Top-selling cars of February 2025

Utes and SUVs Continue to Dominate

Utes and SUVs continued to gain traction, with light commercial vehicle sales up 6.5 per cent and SUVs rising 1.7 per cent. Despite a 6.0 per cent dip, medium SUVs remained the most popular category. Passenger car sales fell by nearly 20 per cent.

The Toyota RAV4, though dethroned in March, remains the best-selling vehicle year-to-date. The Ford Ranger led 4×4 ute sales with 4687 units, followed by the Toyota HiLux and BYD Shark 6.

EV Sales Slide, Hybrids Surge

Electric vehicle (EV) sales dropped by 19.9 per cent in March—the sharpest decline of any fuel category. Petrol and diesel deliveries also saw decreases of 8.3 per cent and 1.2 per cent, respectively. In contrast, traditional hybrids climbed by 22.8 per cent, while plug-in hybrid electric vehicles (PHEVs) experienced a staggering 380.1 per cent rise.

This surge in PHEV demand coincided with the end of the Fringe Benefits Tax (FBT) exemption, which concluded on 31 March 2025. Buyers rushing to secure tax benefits boosted PHEV sales, led by the BYD Shark 6 ute, which ranked just outside the overall top five vehicles sold.

Industry Response to Emissions Targets

FCAI chief executive Tony Weber emphasised that while the variety of EV models continues to grow—now at 89 in Australia—their uptake remains limited.

“We are at a critical point in transitioning to a lower-emission vehicle fleet,” Weber stated. “The early adopters have acted, but the rest of the vehicle-buying public has not followed.”

He reiterated the automotive industry’s support for practical emissions standards, raising concerns over government projections and assumptions around EV adoption.

Outlook

March 2025 signals a mixed but stabilising market trend. While total sales show improvement, underlying shifts in buyer behaviour—particularly around fuel types and brand loyalty—reflect a dynamic landscape. As government incentives change and consumer sentiment evolves, manufacturers will need to remain agile in addressing market demands.

Meanwhile, global developments such as the introduction of steep US import tariffs are expected to reshape international automotive supply chains. Although the Federal Chamber of Automotive Industries (FCAI) believes the direct impact on Australian buyers will be minimal—given the country’s limited reliance on US imports—the wider repercussions may still ripple across markets. Increased production costs and disrupted trade relationships, particularly involving major exporters like China, Japan, and South Korea, could eventually affect vehicle pricing and availability in Australia. The automotive industry now faces the dual challenge of navigating local consumer shifts and global economic headwinds.

Comments

New Comment