A new report by Youi Insurance titled ‘Under The Hood’ has shed light on how well Australians understand their car insurance policies, claims processes, and their rights as policyholders. While a majority of drivers feel confident about their coverage, the survey findings reveal a disconnect between confidence and actual comprehension—particularly when it comes to reading policy details.

Get a Roadworthy Certificate fast and conveniently with CARS24, book an appointment for the inspection; the rest is simple.

Confidence vs. understanding: The national picture

The 2025 ‘Under the Hood Report’ surveyed over 2,000 Australians aged 18 and over across all states and territories. It found that 83% of respondents feel either confident or somewhat confident in understanding their car insurance policies. However, only 58% have read their Product Disclosure Statement (PDS) in full or even partially, raising concerns about how well they truly understand their coverage.

Men reported feeling more confident in understanding their policies compared to women, while older Australians (Pre-Boomers and Boomers) expressed the highest levels of confidence—despite not always reading their PDS thoroughly. Interestingly, Gen Z stood out for being the most likely to read their PDS in full, yet they also reported the lowest confidence in understanding their policies.

Interestingly, those with higher-value cars are more likely to read their PDS in full and feel confident about their policies.

Claims knowledge: A reality check

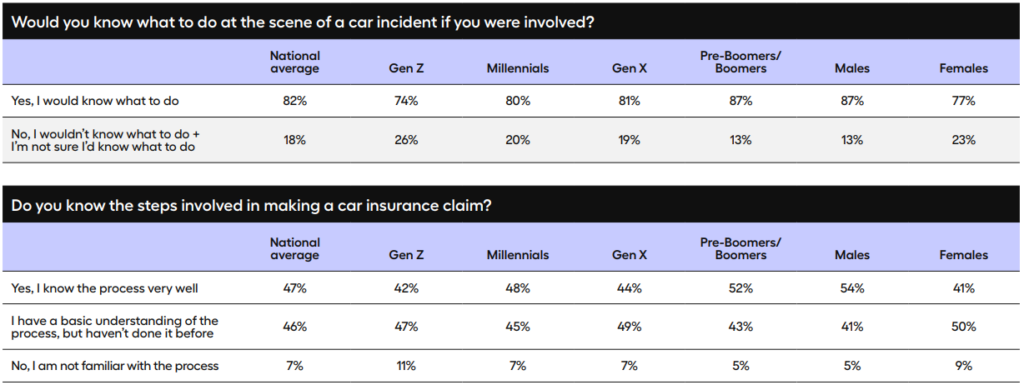

The survey also examined Australians’ knowledge of the claims process. While more than 80% of respondents claimed to know what to do at the scene of an accident, only 47% said they understood the claims process very well. Once again, the survey reported that men were more confident than women in both areas, and older generations were the most self-assured.

However, real-world experience with the claims process has been largely positive, with 81% of respondents describing the process as easy and 79% reporting a favourable overall experience. More than half (53%) needed no additional support when making their most recent claim.

Why do Australians buy car insurance?

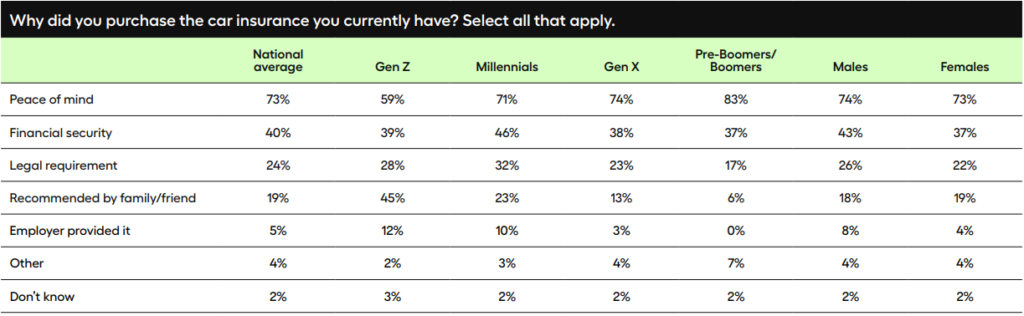

According to the survey, approximately 4 out of every 5 Aussies have some sort of motor insurance beyond the compulsory third-party mandate. When it comes to purchasing car insurance, peace of mind (73%) is the most common reason cited by Australians, followed by financial security (40%).

Cost remains a key factor in choosing coverage levels, with Australians carefully weighing premiums against perceived benefits. However, with such a significant proportion of policyholders not fully reading their PDS, there’s a risk that some may not fully understand their coverage limitations until they need to make a claim.

The bigger picture: What does it mean for drivers?

The findings suggest that while Australians largely feel secure in their car insurance choices, a deeper understanding of policy details and the claims process could benefit many. With nearly half of respondents unsure about how claims work, there’s an opportunity for insurers to improve education and transparency around policy specifics.

For motorists, taking the time to read the PDS and fully understand their coverage could make a significant difference in the event of an accident or claim.

Comments

New Comment