Business car leasing is a popular option for companies seeking to provide transportation for their employees or operate a fleet without the immediate financial outlay associated with purchasing vehicles outright. It involves renting a vehicle for a set period, typically 15 years, with a fixed monthly payment.

Pros of business car leasing

- Cash flow management: Leasing a vehicle helps in managing cash flow effectively as it requires lower upfront costs compared to purchasing a vehicle outright.

- Tax deductions: Lease payments for business purposes are generally tax deductible, providing potential tax benefits for the business.

- Access to newer vehicles: Leasing allows businesses to frequently update their vehicles, ensuring they have access to the latest models with updated safety features and technology.

- No depreciation concerns: Businesses do not have to worry about the depreciating value of the vehicle as they can return it at the end of the lease term.

- Maintenance coverage: Many lease agreements include maintenance packages, saving the business from unexpected repair costs.

Cons of business car leasing

- No ownership: At the end of the lease term, the business does not own the vehicle, and continuous payments are needed for vehicle usage.

- Mileage restrictions: Lease agreements often have mileage limits, and exceeding these limits may result in additional charges.

- Financial penalties for early termination: Terminating the lease before the agreed-upon term can result in significant financial penalties.

- Inability to customise: Lease agreements may have restrictions on vehicle modifications or customisation according to business requirements.

Tax Implications

Lease payments for business use can generally be tax deductible, providing a financial advantage to businesses. However, the specific tax implications can vary based on the business structure and local tax laws.

Lease types

- Operating lease: This type of lease allows the business to use the vehicle for a specific period, and at the end of the term, they can return the vehicle.

- Finance lease: In a finance lease, the business takes on some risks and rewards of ownership, often having the option to purchase the vehicle at the end of the lease term.

Lease terms and negotiation

Businesses can negotiate the lease terms, including the length of the lease, mileage limits, and monthly payments, to suit their requirements and budget.

Maintenance and repairs

Depending on the lease agreement, maintenance and repairs may be covered, offering a predictable cost of ownership.

End-of-Lease options

At the end of the lease term, businesses usually have options to buy the vehicle, extend the lease, or return the vehicle. Residual values, the estimated value of the vehicle at the end of the lease, play a significant role in these decisions. A higher residual value can make purchasing the vehicle more appealing.

- Financial considerations

Leasing might require lower upfront costs and offer tax benefits, but over the long term, purchasing a vehicle may prove more cost-effective.

- Insurance for Leased Vehicles

Leased vehicles often require specific insurance coverage. Understanding and budgeting for insurance costs is vital when considering a lease.

- Environmental considerations

Leasing newer, more efficient vehicles can be a greener option, contributing to the company’s sustainability goals.

Exit strategies

- Planning for the end of a lease is a critical aspect of managing a business car lease effectively. Here are essential exit strategies that businesses should consider:

- Lease renewal: If the leased vehicle still meets the needs of the business, the lease can be renewed. This is an easy way to continue using a vehicle that has proven reliable and cost-effective.

- Vehicle purchase: Many lease agreements offer the option to purchase the vehicle at the end of the lease term. This can be a good choice if the business is satisfied with the vehicle and believes it will continue to serve its needs well.

- Vehicle return: If the leased vehicle no longer suits the business requirements, it can be returned at the end of the lease term. This allows the business to explore newer models or different vehicle types.

- Lease extension or rollover: Some leases allow for a short-term extension or rollover, giving the business a bit more time to decide on the next steps. However, this often comes with additional costs, so it’s important to weigh the benefits and drawbacks.

- Explore new lease options: As the business evolves, its transportation needs may change. Exploring new lease options that align with the evolving needs of the business can be a smart strategy.

- Negotiate terms for a new lease: If the business is happy with the leasing company and the existing vehicle, negotiating new lease terms can be an option. This might involve negotiating a better lease rate or adjusting the lease term to better suit the business.

- Evaluate multiple lease proposals: If the business is considering leasing a new vehicle, evaluating proposals from multiple leasing companies is a good strategy. This can help in securing the best terms and conditions that fit the business’s requirements and budget.

- Early termination: While not ideal due to potential penalties, in certain situations, early termination might be the best option. Businesses should carefully review their lease agreement to understand the associated costs and implications of early termination.

- Plan for vehicle disposal or resale: If the business decides not to purchase the vehicle at the end of the lease, planning for the disposal or resale of the vehicle is necessary. This involves understanding the vehicle’s market value and deciding on the best way to sell it.

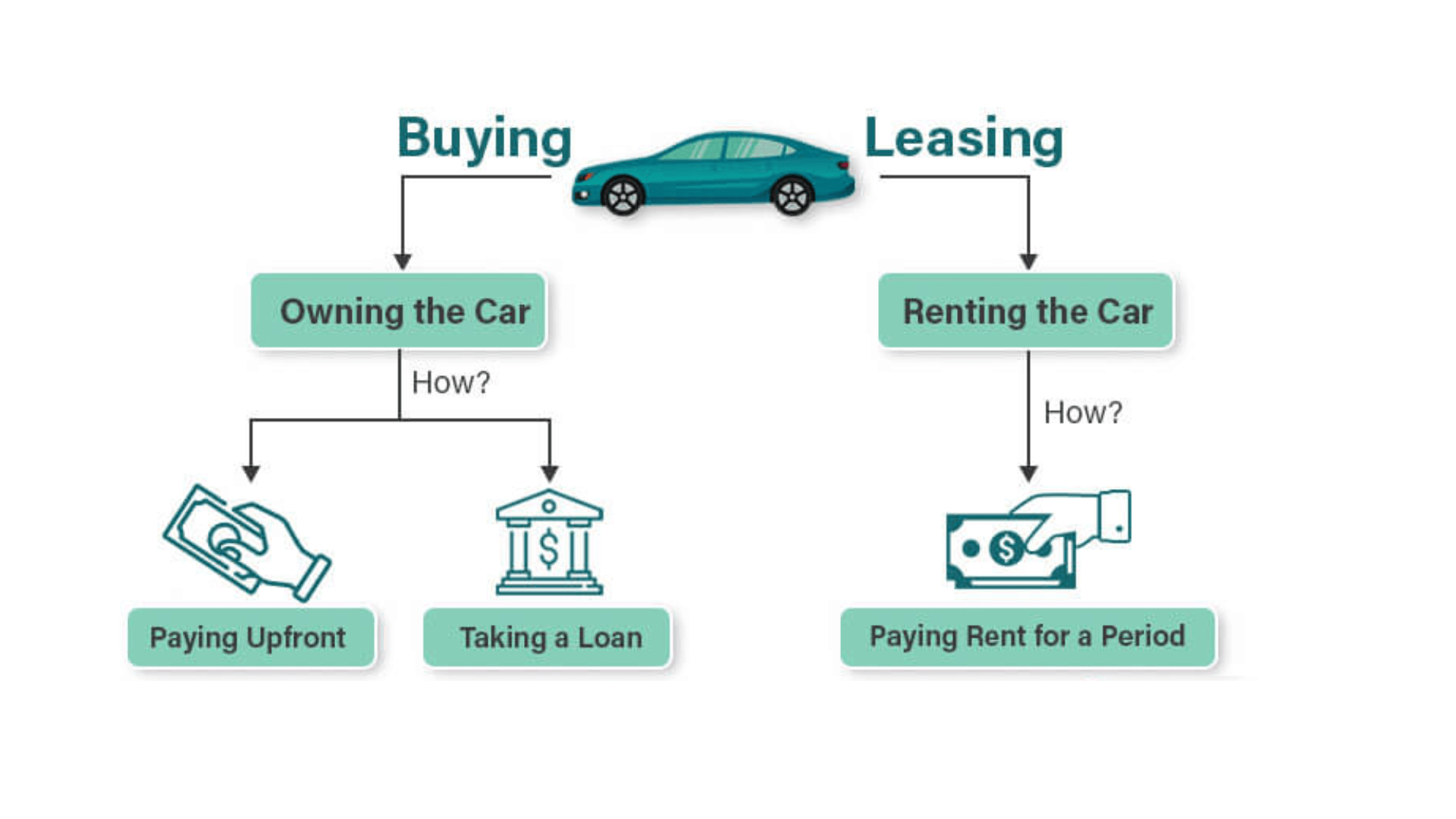

Leasing vs. Buying: A Comparative Analysis

Deciding whether to lease or buy a vehicle can greatly influence your business’s financial health and operational efficiency. Heres a comparison to assist you in determining which choice suits your requirements best.

| Aspect | Leasing | Buying |

|---|---|---|

| Upfront Cost | Lower upfront cost. Usually just the first month’s payment, security deposit, and possibly a few fees. | Higher upfront cost. Typically requires a significant down payment. |

| Monthly Payments | Generally lower monthly payments compared to financing a purchase. | Higher monthly payments, as you’re paying off the entire purchase price. |

| Ownership | No ownership at the end of the lease term; the vehicle must be returned unless you choose to buy it. | Full ownership once the loan is paid off. The vehicle is an asset. |

| Depreciation | Depreciation is not a concern as you dont own the vehicle. | Depreciation affects the vehicle’s resale value; owners bear this cost. |

| Mileage Limits | Lease agreements often come with mileage limits. Exceeding these limits incurs extra charges. | No mileage limits; the vehicle is owned outright, so mileage doesnt impact value. |

| Maintenance and Repairs | Often includes maintenance packages; major repairs are usually covered under warranty. | Maintenance and repairs are the owners responsibility; warranty coverage varies. |

| Customisation | Limited or no ability to customise the vehicle. | Full freedom to modify or customise the vehicle as needed. |

| Tax Benefits | Lease payments are generally tax deductible, potentially offering financial advantages. | Depreciation and interest payments may offer tax deductions, depending on the business structure. |

| Flexibility | Flexibility to upgrade to a new vehicle at the end of the lease term. | Less flexibility; keeping the vehicle long-term means fewer opportunities for upgrades. |

| End-of-Term Options | Can return the vehicle, extend the lease, or purchase it. | Vehicle is owned outright after the loan term; no need to make further decisions about the vehicle. |

| Financial Penalties | Potential penalties for early termination and exceeding mileage limits. | No penalties for early sale or trade-in, but the vehicles value depreciates over time. |

| Insurance Costs | Lease agreements often require higher insurance coverage. | Insurance costs may vary depending on the vehicle and its use. |

| Environmental Impact | Leasing newer, more fuel-efficient vehicles can contribute to sustainability goals. | Vehicles environmental impact is dependent on its age and efficiency. |

Conclusion

Business car leasing offers various advantages in terms of cash flow management, tax benefits, and access to new vehicles. However, it’s essential for businesses to carefully weigh the pros and cons, considering tax implications, financial aspects, and long-term objectives before committing to a lease. With a thorough understanding of the lease types, terms, and end-of-lease options, businesses can make an informed decision that aligns with their operational and financial goals.

Frequently Asked Questions

1. How can business car leases help with cash flow management and budgeting for businesses?

Business car leases aid in cash flow management by spreading vehicle costs over the lease term, minimising upfront expenses and facilitating budget planning for businesses.

2. What tax benefits or deductions are available to businesses that choose to lease vehicles?

Leasing offers tax benefits like tax deductions for lease payments and potential GST credits, improving financial advantages for businesses compared to ownership.

3. In what ways does leasing provide access to newer and more advanced vehicles for businesses?

Leasing provides access to newer, advanced vehicles without substantial capital investment, enabling businesses to stay updated with technology and maintain a competitive edge.

4. How do maintenance and warranty services typically benefit businesses leasing vehicles?

Maintenance and warranty services in leases often alleviate maintenance burdens and costs for businesses, ensuring vehicles remain in good condition and minimising unexpected expenses.

5. How do mileage limits and associated penalties impact the cost-effectiveness of leasing for businesses with high mileage needs?

Mileage limits and penalties can impact cost-effectiveness for businesses with high mileage needs, potentially increasing overall lease costs. Negotiating higher mileage limits is advisable in such cases.

6. How does vehicle depreciation affect the overall cost of a lease and potential resale value?

Vehicle depreciation, a significant cost in ownership, is factored into lease rates. Since the lessee doesn’t bear the depreciation burden, leases can be cost-effective compared to ownership.

7. What are the key differences between finance leases and operating leases, and which might be more suitable for certain business needs?

Finance leases resemble ownership, while operating leases offer flexibility and shorter terms. Businesses choose based on depreciation, financial implications, and their long-term use or ownership goals.

8. Are there industry-specific considerations when selecting a lease type?

Industry-specific considerations may influence lease type choice, particularly in sectors with fluctuating technology needs, seasonal demands, or varying financial structures.

9. How can a car lease calculator help my business?

A car lease calculator helps estimate monthly payments and total lease costs, allowing you to budget effectively and make informed financial decisions for your business.

Comments

New Comment